A. Lange & Söhne & the Pre-Owned Market

5th February 2022

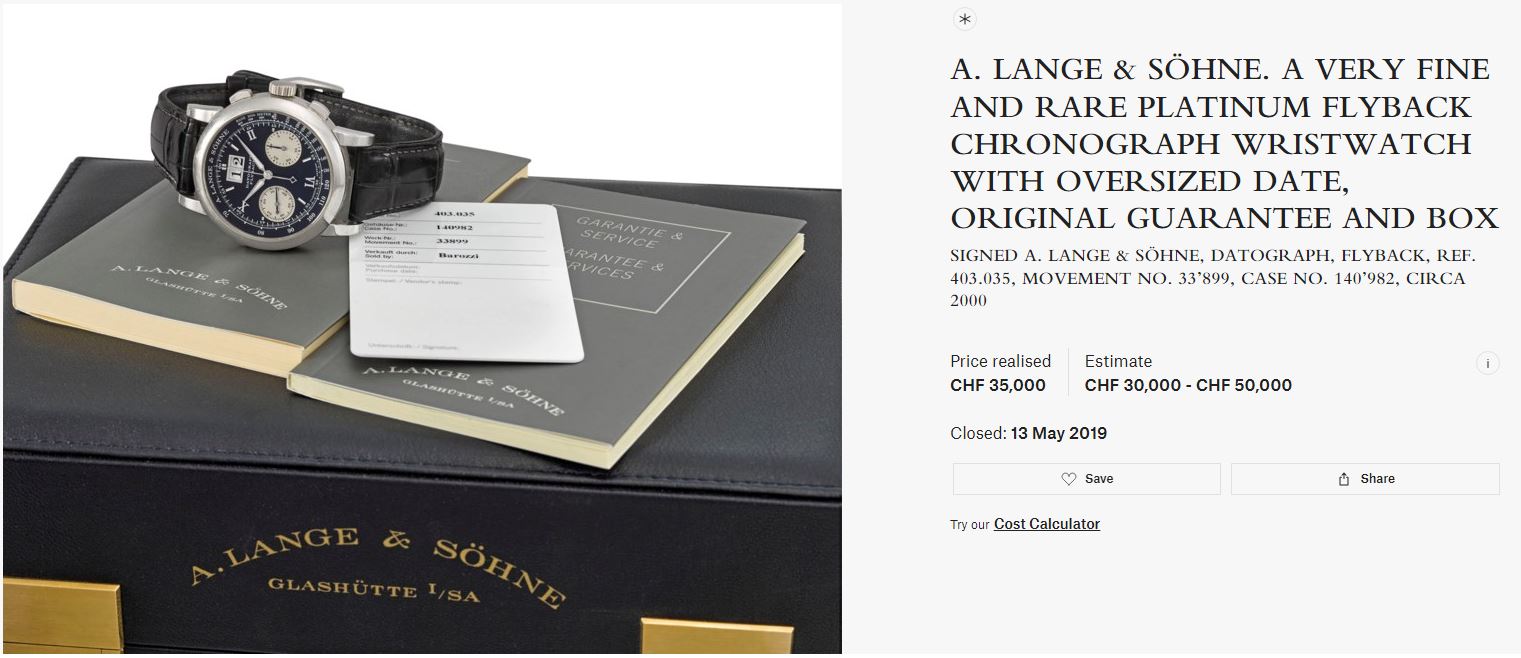

While I’m writing this article in January 2022, A. Lange & Söhne is at its peak (so far) in the secondary market. Yes, there’s still a huge difference between the retail and secondary market prices of the most watches above $150k+, which is a big list comprising close to third of the brand’s catalogue. However, the more accessible range, be it the modern or discontinued stuff, is very strong, meaning selling close to or above retail. Yet, the long-time members of the watch collecting community would remember that this was not the case at all. Indeed, up until 2 years ago, a Datograph Up/Down in platinum was a $55k watch in the secondary market, or the first generation Datograph was at a crazy $35k, which I must admit I’m one of the lucky ones…

Bargain at Christie’s, once upon a time

Well, what changed?

To answer this question, I wanted to pen this article with the help of my friends hailing from different backgrounds and perspectives. Moreover, I wanted to point out a thing or two especially on the value side when it comes to Lange, or watchmaking in general. And of course, I wanted to humbly share my opinions.

To understand today, we must first know about the past.

The Beginnings

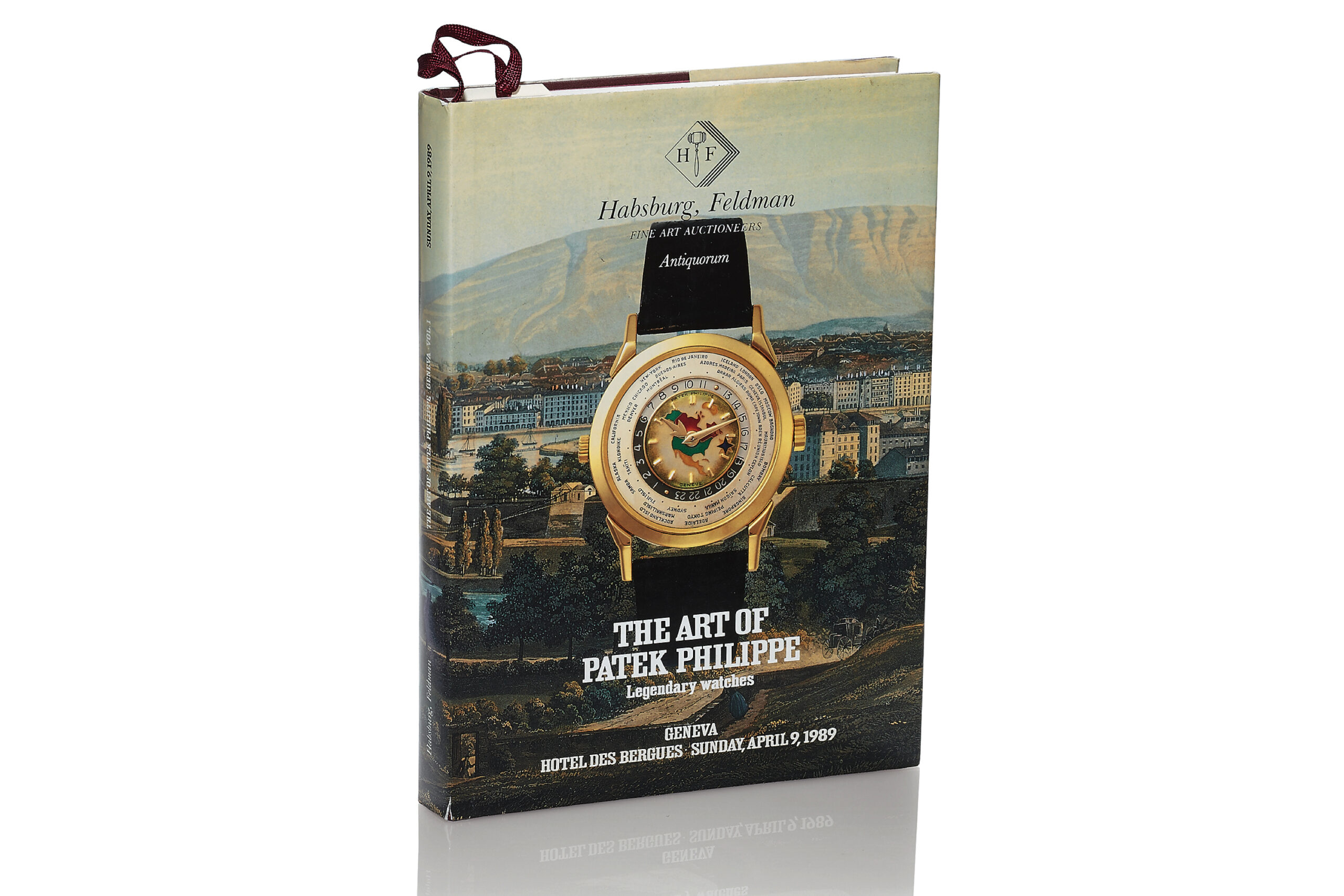

Right from the very start, A. Lange & Söhne positioned itself, with its watches, communications, and pricing, as a brand addressing to the highest end of the market. Carefully selected retailers around the world boosted the brand’s name further, and the recognition increased tremendously with its authentic history and worthy pieces. It was obvious that Blümlein was going after Patek Philippe as he described the rivalry two cavaliers fighting to attract the princess in mutual sportsmanship. At the time, Patek Philippe was already very strong as a brand, but also in the secondary market, mainly following the Antiquorum auction in 1989.

Auctions have always been important indicators of a brand’s perception and popularity, and the best tool we have for the price transparency (albeit with huge flaws at times) in a highly inefficient market. A. Lange & Söhne was re-founded only in 1990 but was already carrying a tremendous history. Inevitably, as the years passed by, we started to see the brand at auctions. A magnificent platinum Tourbillon Pour le Mérite, possibly the most important watch collection that A. Lange & Söhne has ever made, ignited the fire in 1999, selling around its retail price ($90k). In the coming years, as the brand got stronger, the secondary market followed. In 2005, the Tourbillon Pour le Mérite was already selling at auction for double, even triple of its original retail price – deservedly so! You might say now “well obviously this one is going to sell over retail” to which I’d reply there was strength among other special editions as well.

The Lange 1 Tourbillon and other special editions of the brand, like the Emil Lange Moonphase, Grand Lange 1 Luna Mundi, followed a similar trend, selling either very close, or above their original retail price. I’m not surprised by this for two reasons: First, the special editions made back then were truly unique in the market and mostly made in reasonable quantities at accessible prices. Think of a unique piece such as Emil Lange Moonphase (150 pieces in platinum and 250 in pink gold) with a price of $13,200 in 1999 or the 500 pieces Langematik Anniversary in platinum with enamel dial at $23,200 in 2001. At these limitations and prices, the secondary market demand was strong enough to keep the prices near retail.

The second is that, even before the re-birth of the modern brand, as shown by the auction results from Antiquorum, Dr.Crott, Sotheby’s, A. Lange & Söhne complicated pocket watches performed very well. The Lange name still meant something to collectors around, especially in the German Speaking countries, so Lange pocket watches achieved strong auction results in the ‘80s and the ‘90s. One immediate example can be the famous “Jahrhunderttourbillon” which was sold for 1 Million USD in 1990.

The Jahrhunderttourbillon from the turn of the last century

So how about the standard collection pieces such as Lange 1, Datograph, Double Split, etc.. Before moving onto those, I want to highlight two points here: The 2000s was not an era where people paid over retail for in-production pieces. It was a time when secondary market was really the secondary market, a section of the market where people go for bargains. Therefore, I’d advocate that holding value, or even a 25% loss, was a very much success! The collecting culture was not nearly as concerned with holding value or even flipping. One sign of that might the purists’ forum rules strictly prohibited the discussion of prices.

The other thing was that back in the days, the discounts were everyday business. The brands were not shy of offering 50-60% off retail for wholesale purchases, which in return helps the client to accumulate many pieces for even 35-40% discount off the MSRP from the retail store. So, was a 25% loss, really a loss? Just to give you a concrete idea, as I was told by a few industry insiders who were retailers back then, the wholesale price to the retailer for A. Lange & Söhne was around 50-55% of the MSRP.

With this as background, let’s have a look at certain flagship products, starting with the Datograph. When introduced, the retail price for this magnificent watch was $46k in the year 2000. It appeared at the rostrum for the first time in 2003 and up until 2008, the Datograph averaged an auction price of $38k, an average of 25% loss in relation to its slowly, but understandably increasing retail price. Yet, there’s a big possibility that the client did not pay retail anyways. The retailer got the Datograph for a mere $23,920 in the first place…

Recommended Reading: The Collector’s Guide to Datograph

Just to give a better perspective, Patek Philippe 5070 (in gold) was offered at a retail price of $28,900 in 2002 and the price went up to $43,500 in 2006. Patek Philippe 5070 in gold averaged at $60,000 from 2004 to 2008, selling above its retail price.

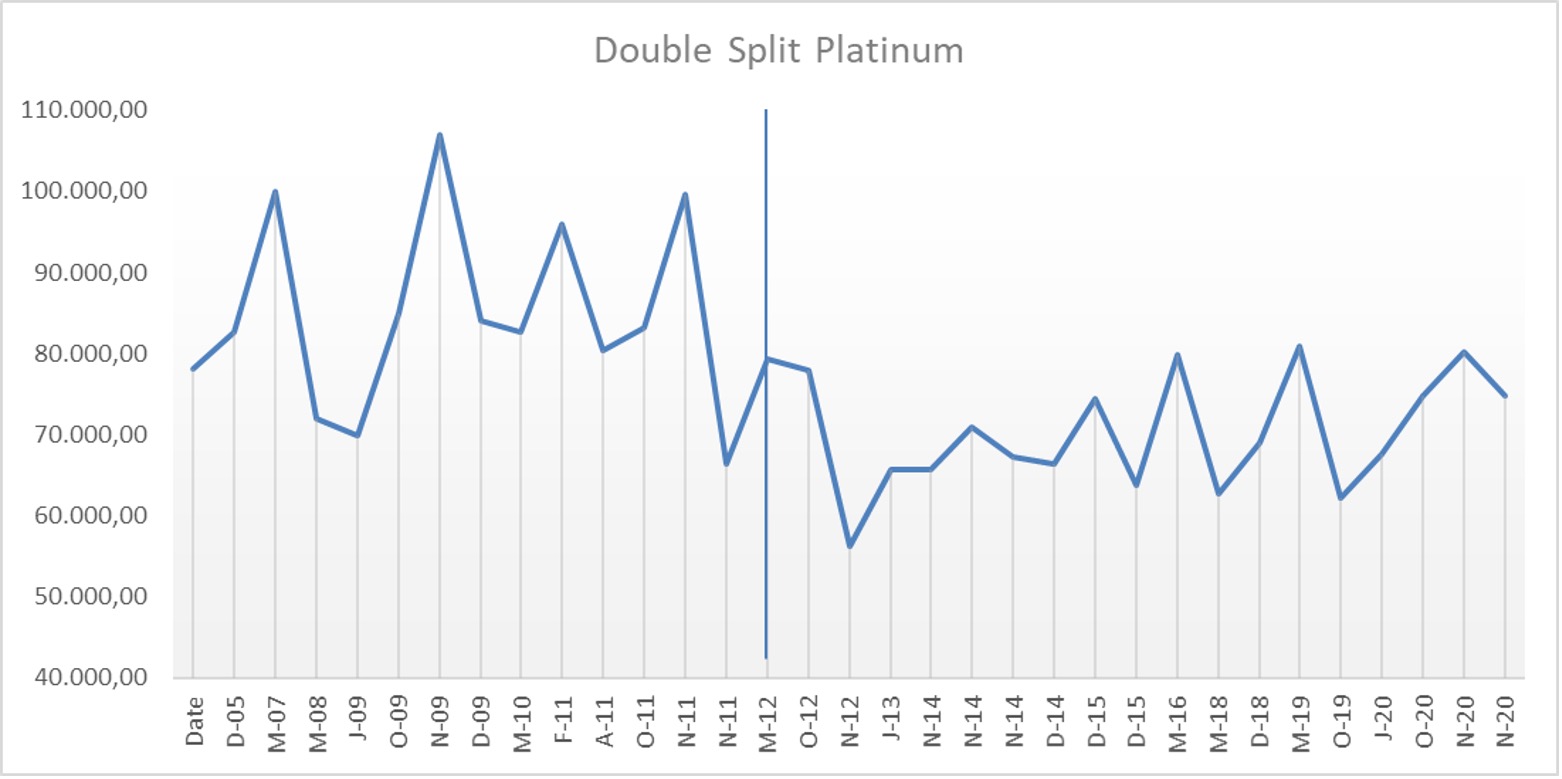

The Double Split, introduced in 2004 with a MSRP of $97,800. It was auctioned for the first time in 2005 and sold around 20% shy of its retail price. However, it got even stronger in the following few years. Right before the financial crisis, the Double Split recorded sales of above $100k. Albeit it dipped in 2009 June at $69k, from 2005 to its discontinuation in 2011, the Double Split averaged at an impressive $86k – 15% shy of its retail, and again, possibly little loss for the owner.

Other standard collection pieces such as Lange 1s, Saxonia, or Langematik were taking a considerable hit against the retail price, understandably as the pieces were already available at every retailer at any time, and people were not as nuts to pay over-retail for time-only pieces. Overall, A. Lange & Söhne’s performance was very much decent, and showing promise for a young manufacture. Even more when one considers the similar trend for Patek Philippe’s Calatravas, or even 3940, etc.

2008 – Breaking Point

Back then, when the brand-owned boutiques were not a thing, the watch fairs were serving as a tradeshow. The retailer would go to SIHH, BaselWorld and order the pieces based on little concrete data, and mostly gut. A saying none other than the former president of the legendary Pisa Orologeria is a nice proof of concept: whoever has the best nose in the watch industry, wins. Therefore, sometimes the retailers would be full-of unsold watches, important ones too. And when a highly important piece sits in the shelf for a long time, it takes out from the brand equity.

On the way to 2008, this was the case for A. Lange & Söhne. As would the experienced collectors remember, the retailers were full of complicated Lange watches without a client. And then, the 2008 financial crisis hit and the remaining few also left, forcing the retailers to dump the pieces at huge discounts. The reflection in the secondary market was severe. For example, the Lange 1 Tourbillon in platinum (retail price was $106k in 2001) recorded an average sales price of $140k from 2004 to 2009 at auctions. Following 2009 the average fell to $100k.

Double Split and some others followed the same suite. For example, the average sales price (at auctions) of the Double Split from 2011 up until 2019 fell to $69k from the previous $86k. Even more of a free-fall considering the drastically increasing MSRP. Perhaps in response to set a shoreup falling market prices, A. Lange & Söhne took two interesting actions: Re-designing some fundamental collections and strong hikes in the MSRP.

Recommended Reading: An in-depth look at the Double Split

This was a very interesting era for A. Lange & Söhne. We saw two management changes from Mr. Krone to Mr. Lambert to Mr. Schmid in the span of three short years (2008-2011). With these winds, came the changes to many staples of the catalogue – references such as the first generation Datograph, 1815 Chronograph, Double Split, Datograph Perpetual were discontinued or replaced with new designs. It would seem the management sensed something was wrong, and thus tried to address to a broader customer base with the changing design language. For the most part, it backfired. The Datograph Up/Down did not bring the needed excitement when it was launched… Likewise the 1815 Chronograph was a bit of a flop and had a production span of a couple of years before being discontinued.

The other side of the coin of course was the MSRP increases. For example: The first generation Datograph was priced at $65,300 in 2010 and suddenly jumped to $74,400 in June 2011, and $78,400 in September. The Datograph Up/Down, introduced a year later was offered at $87,400. This is %30 increase in a span of two years.

Another example can be the Zeitwerk. When introduced in 2009, the price was $54,500 in gold. One can say it was way too cheap to be honest, but that’s another topic. Its price went up to $67k up until 2012 and in 2013, it was suddenly $77k. %40 increase in a span of four years. Or the double split in pink gold. $109k in 2011 and $128k in 2013…

The secondary market, however, did not follow such hikes, nor the design changes. As the brand was trying to position itself even closer to the top of the pyramid with its prices, the secondary market was holding back, and the gap was increasing day by day. Despite being discontinued, between 2011-2015 the platinum double split averaged at $68k – a considerable drop from its previous 5 year average (+86k) and close to 50% off (possibly still ok for the store as they bought with the wholesale price) from its MSRP. Same trend was present for Datograph, Zeitwerk, and unfortunately, even the very special references like Handwerkskunst. Lange 1 Tourbillon Perpetual Calendar Handwerkskunst was auctioned in 2015 and sold for $192k against a retail price of $350k.

Recommended Reading: An in-depth look at the Lange 1 Perpetual Calendar

Why though? Why such a sudden drop? Here, I wanted to ask Mike Manjos, head of global trading at WatchBox. With his 30+ years of experience from the market and a Lange retailer back then explains the fall of secondary market and the increasing gap as follows:

In the 2010s, I was already a Lange retailer close to a decade. Sure, they were never selling like hot cakes, but it was decent, says Manjos, reflecting on the topic as one of the first official retailers in the US. Following the financial crisis, people wanted to move onto safer bets. Though I was and am one of the biggest fans of the brand and tried to explain everyone that Lange is amazing, the brand had a very short track record and constant management changes at the time. What’s more, as you pointed out, the price hikes were steep and as the gap between the retail and the pre-owned market started to take off during the 2010s, it started to reflect to the overall image.

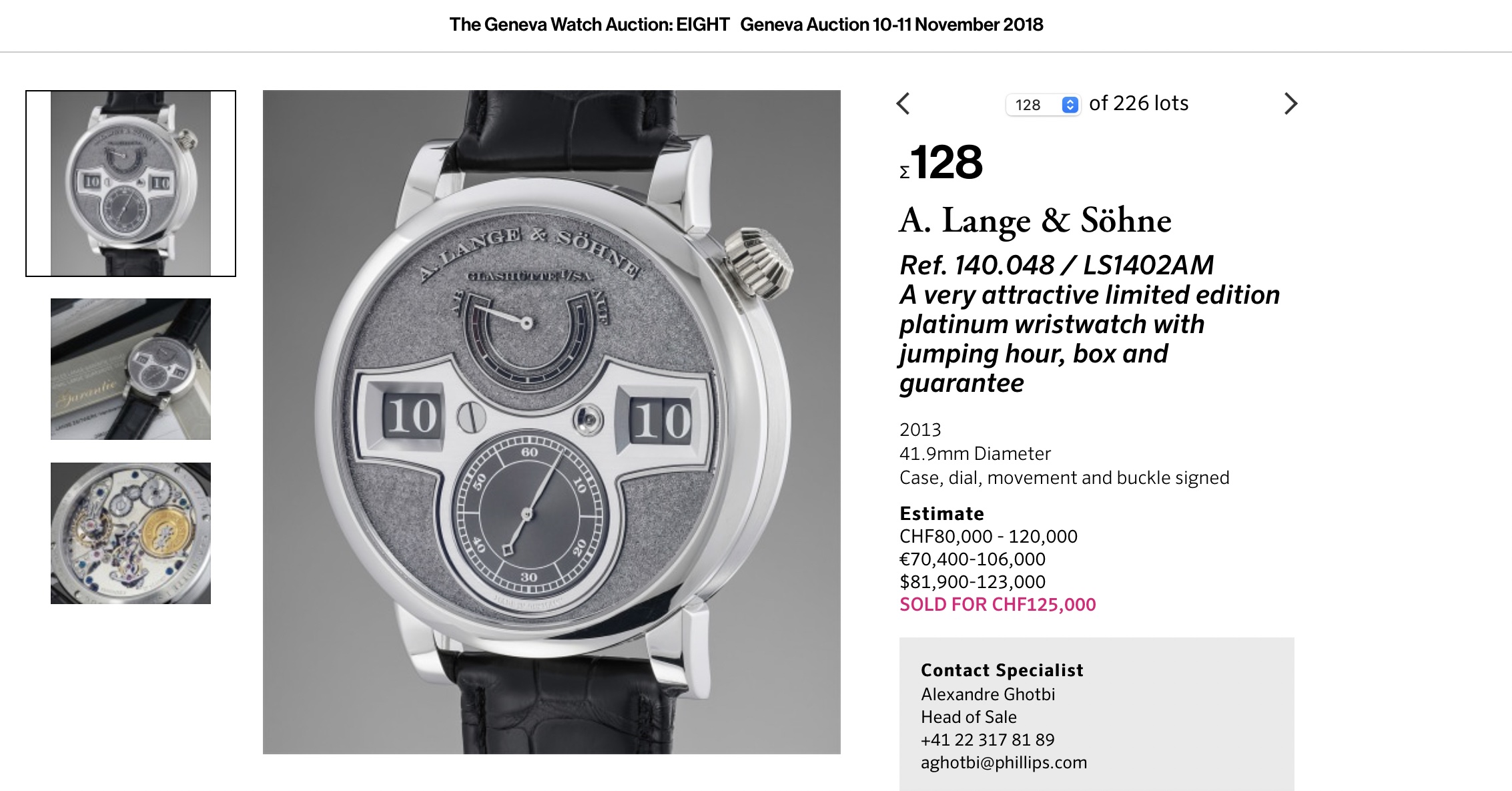

I must also point out the brand’s changing product strategy. In the 2010s, A. Lange & Söhne went full throttle on complications without any care about something called wearability, nor accessibility. 2011 brought us the Richard Lange Tourbillon Pour le Mérite, an avant-garde piece that houses brilliant watchmaking at $210k… Or, Lange 1 Perpetual Calendar Tourbillon, a Mike Manjos favorite, at a whopping $300k+… And then the Terraluna, a feat of creativity and craftsmanship at 45.5 x 16.5 mm dimensions, 1815 Tourbillon, 1815 Rattrapante Perpetual Calendar etc… The reason behind the success of the 2000s’ special editions were right production numbers, creativity and price, which was almost completely ditched in the 2010s. It makes more sense of course, to sell one of these instead of selling 10 Lange 1s. Alas, it was, and to an extent still is, a bloodbath for these references. $300k+ Lange 1 Perpetual Calendar Tourbillon started to sell for around $140k, if you’re lucky.

The period between the 2010s to 2019 was an amazing period for the buyer where one could find very special Lange pieces for peanuts (compared to today). Pieces like Lange 1 Tourbillon was going for $60k, regular Lange 1s for around $20-25k even in platinum, first generation Datograph for $35k, Lumens for 1,5x over retail, and even the Tourbillon Pour le Mérite for around $150k…

Odysseus and Retail

In 2019, A. Lange & Söhne introduced something that would open the brand to a much broader crowd: the Odysseus. The first serially produced stainless steel, 120 meters waterproof watch of A. Lange & Söhne. The one that added more fuel to the steel sports watch craze, but in its own character. You can find my detailed walkthrough of the Odysseus, here. Ah, and the watch itself is not the focus of this article, it is more about, what this watch has done?

When introduced, Odysseus caused a big split within the community. Many disliked it, many made fun and in between, some collectors managed to snatch the piece while it was still readily available. Months passed by, and the Lange Odysseus started to get warmer and warmer. Many had the chance to try the watch, and I must say that the Odysseus really shines when it is on the wrist. In time it became A. Lange & Söhne’s first non-special, non-limited edition watch to have a considerable waiting list. Of course, this was not just because of demand – the other factor helped tremendously!

A. Lange & Söhne has been altering its distribution strategy for some years, copying mainly what Audemars Piguet has been doing: moving everything into in-house boutiques, mainly to combat with the retailer situation described earlier. When the brand started to have full control over its network, the Odysseus had only one chance to leave the boutique on the owner’s wrist: at full price, and sometimes, well mostly, with a bundle. We all know what happens when something is not readily available, and someone tells you that you cannot have it… You got it! More people want it!

Here, I’d like to open a parenthesis for the bundling: The process basically means that if you do not have (enough) track-record with the boutique that you’re trying to get the Odysseus, you must purchase another watch to reach a certain spending. At the beginning, this piece was something like Richard Lange, 1815 Up/Down, etc… one might say slow movers. So, in order to get a watch that you like, you must get a watch you don’t want.

According to A. Lange & Söhne, this is a process to see whether the buyer is genuine and prevent the flippers. On one hand, I find the core idea justifiable. Because with watches like this you’re going to have flippers knocking on your door, and for A. Lange & Söhne this was the first time such a thing happening- hence the brand’s elimination process. Moreover, many people want the so-called hot watches without supporting the brand in any other way. Therefore, I think that this transparent approach, this policy, is certainly alright.

On the other hand, the problem starts when the brand doesn’t count the purchases made from an authorized dealer. Indeed, many collectors openly stated that their purchases from their ADs (because they didn’t have a Lange boutique in the region) were discarded on an attempt to purchase an Odysseus at the boutique and they were asked to bundle. These were the people who supported the brand at their worst. So, you make your own deduction from here.

What’s the result, then?

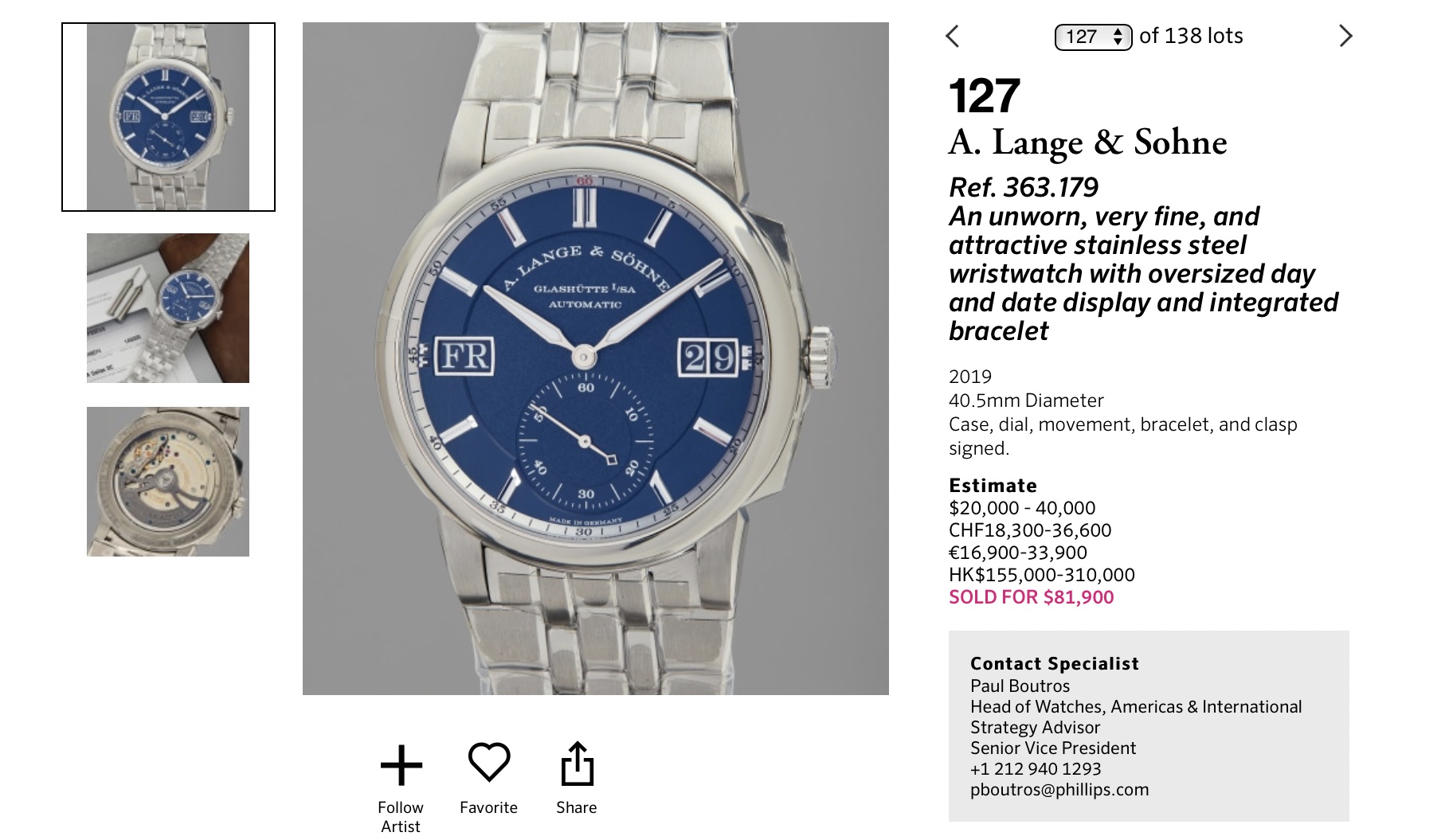

The Odysseus made its debut on the auction block in December 2020 via Phillips, a year after its launch selling for more than $80k. As of January 2022, Odysseus sells close to 2.5x of its retail price. What Odysseus did is bigger than itself. As my dear friend Dave (itsbeenalangeday) puts it, the Odysseus sprinkled some hype fairy dust on the brand. Indeed, finally a serially produced, non-limited, non-special A. Lange & Söhne watch to sell at premium at a time where the secondary market value is the king.

First Odysseus to appear at an auction via Phillips Watches in Association with Bacs & Russo

Coronavirus & Watch Market

Coronavirus’ effect is two-fold. The first is the shutdowns it caused, and the second is the time it gave. Let’s start with the bottleneck.

The basis of luxury theory is to supply less than what the market can absorb. Up until Covid hits, one could see almost every A. Lange & Söhne reference, from the most complicated ones to the signature ones like Lange 1, 1815 Chronograph, sitting on the shelves for considerable time. So, there was no rush in purchasing anything as almost all was instantly available.

As it did to the global supply chain, the watchmaking industry’s production side took its toll from Coronavirus. The suppliers from Switzerland, China, Europe remain shut for months, the customs, ports were closed or slow to reply and on top, the manufacture remained closed (or half capacity) for months. Such closures already disrupted the supply & demand balance, and another factor added more to the fire: Liquidity.

Mr. Cheng Shing Chow (‘Shing’ or ‘wristshotdude’), a very-well seasoned collector and investor-entrepreneur notes here: An important factor that must be raised here is the liquidity demand – yes there is an immense amount of both institutional and individual liquidity and a lot of it is driven by Chinese and American Money. This liquidity is immense – its impact on watches is just a small part. Its impact on property and art in general is far more significant. Watches are a small subset of this tsunami’s consequences.

Financial Times‘ report on the market

Which brings us to the booming watch market. Towards the end of 2019, the secondary market was already becoming the primary market and people were more than used to paying over retail for what is called hot watches. A factor we must not oversee here is that the watches are not perceived as they were 10 years ago. To a significant population, watches are now an investment class.

Mr. Cheng continues: The immense increase in liquidity pulled-up certain segments (‘lower’-end & retail-priced such as Rolex; higher-end and higher retail-priced like Patek, ALS, AP) of the watch market.

The market rejected the middle segment which were immensely popular from 2005-2015, and far overpriced but lower in the price-quality value ratio (impacted greatly too by the end of the ‘gifting culture’ in China in 2014, due to a clampdown in corruption). The lower buying end of the market moved towards robust, dependable watches (like Rolex*), and the higher end of the market went towards well made, well finished, much rarer watches (like ALS, Patek, Royal Oak) – with a particular preference for the male aesthetic of sports watches. That is the story of 2020 and 2021 – these sought after, higher-than retail, premium loaded watches became more and more expensive. The result? For a mass brand like Rolex to be unattainable, the buying market becomes unhappy and reacted by starting to look at the neglected ‘middle’ segment. For the higher-end consumers, more and more high-end independent brands became more sought after.

Have a look at the usual suspects: Richemont just reported 59% sales growth in Americas and 12% in Europe compared to pre-pandemic levels where the specialist watchmakers division grew 20%. Not only the big ones, but also the independents posted tremendous appreciation. Grönefeld stopped taking orders, DeBethune quotes 2-3 years for the Starry Varius… The auction houses’ watch departments’ posts record sales session after session, and A. Lange & Söhne is rightfully benefitting from the craze, perhaps above average when combined with the internal factors mentioned above.

So, where is A. Lange & Söhne’s secondary market now?

Most of the attention is focused on the following collections: Lange 1 (Early, even better if colorful), Datograph (Base, Up/Down), 1815 (Early), Lumen, Handwerkskunst, and basically anything that is limited or special. There’s not much focus on the modern references as of now, but the special editions such as the 175th Anniversary already performed brilliantly. Dave continues further, I think that there was a Journe-like phenomenon where collectors woke up that these were important watches, in far more limited production than Patek Philippe, and then sought out the early pieces especially. The dissemination of knowledge through Instagram, you (Langepedia), etc., had a lot to do with this as well.

To give a few concrete examples on the secondary market, for the Lange 1 series, the white metal and colorful (non-silver) variants command almost double, triple premium from two years ago. The Darth around $80k, the blue dial versions around $70k, the closed caseback Lange 1 variants above $100k… Though you’d see regularly see dealers putting the pieces at astronomic prices, possibly to find a buyer in a saturated market where there’s not many data for the buyer to make up his/her mind.

Recommended Reading: Understanding the Lange 1 Darth

The first-generation platinum Datographs are offered around $100k, though tends to find a buyer at a lower price. First generation 1815 Chronographs come with an asking price of $60k. The Datograph Up/Down also benefitted from the rise across the board and comes with an asking price around $100k, too.

The Lumen and Handwerkskunst Series fetches astronomic prices regularly. Datograph Lumen seems tofind its range above $300k+, and Handwerkskunst collection pieces go as high as $650k+ depending on the piece.

But, in my opinion, there are still bargains. Huge ones. I think that the early Saxonia collection with the legendary Sax-0-Mat caliber is a steal now. This includes Langematik Perpetual references as well. Within the early chronograph range, only the Double Split platinum did not get the boost as the others. Richard Lange Pour le Mérite or the Zeitwerk collections are another unique lines that didn’t get the same lift as others and travels still under the radar. Lange 1 Soirée collection is another example of a bargain.

Recommended Reading: An in-depth look at the Langematik Perpetual

The bargains also continue with high complications. A Richard Lange Tourbillon Pour le Mérite trades around $110k against its retail of $200k+. A Lange 1 Perpetual Calendar Tourbillon can be found as low as $190k, against its retail of $350k+. So is the 1815 Tourbillon, Datograph Perpetual, etc… When things get crazy on one side, it is always better to look at the other way, and there are plenty of things there.

Brands like A. Lange & Söhne needs studying to be appreciated. Indeed, there’s a face value but the art goes much deeper, and one needs time to dig-deep. Combination of all these factors, from the Odysseus to the brand’s distribution strategy, to the extreme imbalance between supply/liquidity caused by Covid and central banks and finally with the time at hand for collectors to learn more, seem to lift the higher-end watchmaker and therefore A. Lange & Söhne to the new heights.

If I may say, one negative result of such appreciation of popularity however is the speculators, or wolves cloaked as sheep. When I start to see rocket emojis under a watch post on Instagram, I know that the community is tainted. I’d say that the Lange collector has always been the one in the know, and collect purely for joy, alas, it changes. Therefore, it is always important to interact with the right people.

I do hope that this article would be a valuable source for those who just start A. Lange & Söhne, or who try to make sense of what’s going on in the market. It is always important to know about the development hence I hope that this article would make a good use.

I would like to thank my friends Dave, Mr. Sheng, and Manjos of WatchBox for their invaluable contributions to this article. If you have anything to add or discuss, please kindly contact me via [email protected].

Please feel free to contact:

Follow Langepedia on Instagram:

Watch “A. Lange Story” Documentary, in partnership with WatchBox:

FAMILIES / COMPLICATIONS

STAY IN TOUCH

Sign up for the newsletter to get to know first about rare pieces at Marketplace and in-depth articles added to the encyclopedia, for you to make the most informed choice, and first access!